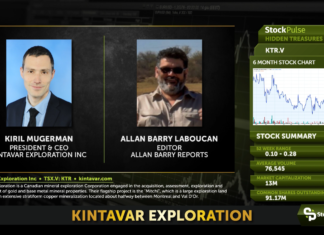

Kiril Mugerman, StockPulse Transcript c. 5,000 Words

HiddenTreasures: Kintavar Exploration

StockPulse, December 20th 2019.

TRANSCRIPT

—

Text quotes KIRIL MUGERMAN, CEO of KINTAVAR unless otherwise noted.

This episode features KINTAVAR EXPLORATION. Ticker KTR on the Venture Exchange. CEO KIRIL MUGERMAN now ALLAN BARRY, hello.

ALLAN BARRY: Thank you for joining me, it’s Allan Barry Laboucan from the Allan Barry Report and StockPulse. Today we have the second edition of our “HIDDEN TREASURES” shows. With me KIRIL MUGERMAN — I hope I said your name properly. Kiril from Kintavar Exploration.

KIRIL MUGERMAN: Thanks, Allan. My pleasure to be on the show. Yes, you got my name. One of its many versions.

ALLAN BARRY: Good. I like to get it as close as possible.

ALLAN BARRY: I started watching Kintavar probably about eight or ten months ago. What got my attention was a lot of very thorough exploration work, exposing stuff at the surface and sampling it quite thoroughly. I was waiting to see the start of drilling. You’ve started a 5,000-metre program now and I read you’re at about thirty-nine hundred metres finished so far? Please give us some color on your exploration efforts that led you to the drill program.

KIRIL MUGERMAN: Sounds good. I’ll start with a little bit of history.

KIRIL MUGERMAN: The property was first discovered around 1971. They were following up on marbles mineralized with copper. They automatically thought skarn deposits.

KIRIL MUGERMAN: They were running out of ore at one of the Quebec deposits, the Gaspé Mine, Gaspé Peninsula.

KIRIL MUGERMAN: They came across this rock and they sent geologists to drill a couple of shallow holes. “100-foot holes”. 15 holes total. They said, “low grade doesn’t make it. We don’t like it.” and walked away. In 1971, copper price was lower. You needed grade. They came back in the early 2000s and did a bit more geophysics. They did IP because they were still going with this model — they were looking for areas where you had lots of sulphides. IP picked out one area and they said, “Okay, let’s go there.”

KIRIL MUGERMAN: There was one outcrop and they said, “It’s all pyrite and pyrrhotite.” and they walked away.

KIRIL MUGERMAN: Then a company called — sorry, I’m drawing a blank here — ANDRE GAUMOND’s company… Virginia. They came here in 2003-2004.

KIRIL MUGERMAN: They were doing a bit of surface work, never drilled. They said, “Yes, soil anomalies but we are so much focused on our gold assets in the north…” Good that they did, as that became their big discovery. It panned out.

ALLAN BARRY: Their famous deposit in the north was ELEONORE.

KIRIL MUGERMAN: One of their geologists who was running their program on ELEONORE was ALAIN CAYER. Alain is my VP of Exploration in KINTAVAR. He was fully trained by ANDRE GAUMOND and PAUL ARCHER.

KIRIL MUGERMAN: That’s why you see us doing a lot of this trenching and the science work — this is the exact same approach as Virginia with lots of background work done before you start plugging in holes. And that’s how you get discoveries.

KIRIL MUGERMAN: I had very similar training in GOLDFIELDS, the South African company where I used to work as an exploration geologist. That’s the approach we use.

KIRIL MUGERMAN: Alain, for the record, when he was working for Virginia and ANDRE GAUMMOND, he was the guy who discovered the ROBERTO mineralization, which led to the discovery of the entire ELEONORE deposit. They have a very good relationship.

ALLAN BARRY: Now that you mention it — I remember looking at your company when I first saw that a Virginia mining guy was involved… That got my attention. I know Andre quite well. He is a very thorough explorationist. I can see that in your exploration efforts.

KIRIL MUGERMAN: We have another person, Francis Chartrand, who joined us as a technical advisor earlier this year. He is another ex-VIRGINA guy that believes in this thorough work-on-the-ground approach. We kind of “brought him out of retirement” to work with us a bit.

KIRIL MUGERMAN: When we got in there in 2017, we were basically the first guys to really come in and bring an excavator to start digging trenches. Until then, people would do soils and it would light up like a Christmas tree. Everybody would say, “there’s something there” but all the outcrops are basically gneissic units.

KIRIL MUGERMAN: As you know Allan, your marbles are softer so they weather down — they are always covered. The gneissic units stick out and you can sample them, but there’s nothing there. Nobody brought out any heavy machinery until we started doing the first few trenches. That’s where we discovered SHERLOCK.

KIRIL MUGERMAN: We were like, “Wow. This is amazing.”

KIRIL MUGERMAN: We start doing a bit more detailed work on that big trench, which I believe was close to 30 metres by 15 meters. We brought MICHEL GAUTHIER, which is another ex-VIRGINA guy. You’re picking up on the theme, I guess.

ALLAN BARRY: Yes.

KIRIL MUGERMAN: Now, MICHEL GAUTHIER helped Virginia a lot in the metamorphic conditions, delineations, and figuring out how the gold formed — the roots and all stuff of metal genesis. He is a professor at UQAM of metallogenesis who worked a lot with ANDRE GAUMOND.

KIRIL MUGERMAN: And ALAIN CAYER knows him well, so we brought him to advise us a little bit as well. We started following the mineralization and then we started seeing the mineralization is literally following the marble units. Even when it’s folded, it’s still within the unit. You can see the mineralization being folded around non-mineralized units. That was the first indication that we are not in the skarn environment, where mineralization is basically a cloud of fluid going through and precipitating.

KIRIL MUGERMAN: Geologically speaking, we are within the GRENVILLE.

KIRIL MUGERMAN: Of course, QUEBEC is known for gold in Val-d’Or, the JAMES BAY – ABITIBI. The gold is not in the GRENVILLE — it’s all in much older terrains, which are much less deformed. The only things that are in the GRENVILLE in Quebec are the iron deposits and the graphite deposits. That’s because GRENVILLE has seen a huge amount of deformation. That deformation was bought by pressure, by squeezing and folding rock.

KIRIL MUGERMAN: As well, by bringing high temperatures, which metamorphose the rocks. Because of this metamorphism, you could not identify any of the traditional rocks which are associated with stratiform copper deposits.

ALLAN BARRY: They’re altered.

KIRIL MUGERMAN: They’re all altered due to metamorphism, correct. We had people say, “Well, it’s in the marble — it must be a skarn. In Quebec, you have some copper in skarn.” They always go on old notions that don’t apply here — they have all been metamorphosed in granulite facies.

KIRIL MUGERMAN: We were not afraid of the metamorphic conditions because we had MICHEL GAUTHIER on our side, who is extremely good at reconstructing the pre-metamorphic conditions based on what we are seeing now. He has done the thin section work for us to rebuild the original constituents — what were these rocks? That gave us a lot of confidence. Then we started drilling.

KIRIL MUGERMAN: The first few times we drilled were based on trenches. They were big, but not as big as some of the recent trenches that we’ve done this summer. They gave us an indication that we are looking at tightly folded, sub-vertical units.

KIRIL MUGERMAN: Basically, the marble horizons got folded. Sometimes we’ll drill through the same fold that got folded three or four times.

KIRIL MUGERMAN: As you go through the same horizon again and again over a hole 120 metres deep, you just drill through the same fold several times. That was the first interpretation we got something really interesting.

ALLAN BARRY: Good.

KIRIL MUGERMAN: Really good results from there — I think the first discovery hole was 120 metres of 0.34% copper from surface. Then, we had 130 metres of 0.31% copper. We had just under 100 metres of 0.4%, the biggest hole at first. There is silver, too. The silver grades run anywhere between 2 grams and 10 grams per tonne.

KIRIL MUGERMAN: Now, it is a little bit low for stratiform copper deposits. Usually, there are 30 grams to 100 grams per tonne. Because the silver is sitting together in the same structure with the chalcocite and the bornite, they float together. When you recover copper, you recover silver. By the time you get your copper concentrate, your silver is at a high enough level that is payable for any smelter.

KIRIL MUGERMAN: We are reporting silver, as well. When I quote drill results, I don’t mention silver, but silver is a payable.

KIRIL MUGERMAN: That’s how it all started, then we raised $10 million dollars in 2018 on the success of those results. It was the first time we had primary copper mineralization in Quebec in — what? I believe it was over 20 years? We got the Quebec pension fund involved. They hold, today, I believe 14% of the company.

ALLAN BARRY: Not everybody that’s listening to the show is aware of what kind of investors those funds are, but they’re often just like an insider. They’re not buying it really for investment purposes, so much as giving you funding to go ahead and do exploration. That’s what they’re promoting.

KIRIL MUGERMAN: Quebec has a lot of interest in investing in local projects of merit. They say, “We are going to take a position. We want to make sure you have the money, we want to see it progress. If it’s a good project we’ll reinvest again. We’ll reinvest again.” And they basically never sell until they say “OK. We think that project is no good anymore.” Or if they have to get below 10% ownership.

KIRIL MUGERMAN: They try to stay below 10%, as with most of the Quebec institutions. In our case, we were the first company “pre- Resource Estimate” where they took a position more than 10%.

ALLAN BARRY: And this was SOQUEM?

KIRIL MUGERMAN: No, this is the Quebec pension fund, the CDPQ. They invested. The Labour Fund invested. The People’s Bank invested. Those funds took a very large stake in the company.

KIRIL MUGERMAN: I believe today by the time you look at all the private equity groups that hold the positions here with us plus a lot of the people from the region where we are — we haven’t really discussed it yet, but the local people in the region of MONT-LAURIER where we found this property are invested.

KIRIL MUGERMAN: As I said, we are outside the traditional “northern Quebec gold zones”. We are really in the forestry region.

KIRIL MUGERMAN: The people of MONT-LAURIER hold together 25-30% of the company. They are all private investors. They are all below 10%. Some of them hold 3, 4, 5% each and they’re big believers in developing their region.

KIRIL MUGERMAN: Their region does not have mining. There is a graphite mine back from the 60-70’s that’s still operational and that’s the only mine in the region. All the GRENVILLE mines for iron ore are further north.

ALLAN BARRY: Yes.

KIRIL MUGERMAN: We raised ten million dollars and we started bringing many majors to site. Showing them what it is. Everybody was very curious and from then until now, it’s continuing. It’s an educational process to the investor because when people see a hundred twenty metres of mineralization of 0.34% copper, they automatically think okay it must be a porphyry deposit. It is not.

KIRIL MUGERMAN: It is a stratiform copper.

KIRIL MUGERMAN: They got squished so badly that everything is basically folded.

KIRIL MUGERMAN: Now, this was the interpretation of 2017-2018. In 2019, you refer to the trenching. We did a lot.

KIRIL MUGERMAN: Why did we do so much trenching after already completing ten thousand metres of drilling over the entire property.

ALLAN BARRY: Because you could strip-back the dirt to bedrock and take samples!

KIRIL MUGERMAN: Correct. We can get much more information from surface.

KIRIL MUGERMAN: If you look at the property, the sedimentary basin we control 100% is approximately 15 kilometres long.

ALLAN BARRY: Are there some comparable deposits to what you’re talking about here?

KIRIL MUGERMAN: Not really. Stratiform copper deposits? Yes. But stratiform copper in high-grade metamorphic granulite facies? Absolutely no.

KIRIL MUGERMAN: That’s why it’s very unique. We had that discussion with one of the majors. It’s very interesting because the majors are now starting to look at, “How do you find copper deposits?” Go in the non-traditional zones.

KIRIL MUGERMAN: Those non-traditional zones are high-grade metamorphic terrains that have not been explored. The rock that we are used to does not look the same way. If I told you to look for a porphyry deposit that is one or two or three billion years old, then you’d say “Well, no. All the porphyries are young and we know how it looks.” That’s how we found MALARTIC, which is a porphyry. Windfall Lake in Quebec is a porphyry, as well. But since they are of a totally different age and metamorphic conditions, they look different.

KIRIL MUGERMAN: It took time for OSISKO to demonstrate it with their success at MALARTIC. Look at what OSISKO METALS is doing now — they are looking at zinc in those high-grade metamorphic terrains.

KIRIL MUGERMAN: We had results of some drill holes which were very positive. We were very happy with it, but then we could do a step-out and not get the same thing. We thought, “That doesn’t make sense.”

KIRIL MUGERMAN: That’s where we started suspecting that our structural interpretation was not correct. We said, “We’ll wait.” That’s why we didn’t drill last winter.

KIRIL MUGERMAN: We said, “In the summer we are going to trench as much as we can.” We did was a few huge trenches. When I say huge, I think one of the trenches is almost 100 metres long by 50 metres wide.

ALLAN BARRY: You put that in some of our promotional material.

KIRIL MUGERMAN: We published a picture from a drone where you can see a geologist’s red vest looking very small.

KIRIL MUGERMAN: Those trenches, for the first time, allowed us to really visualize the mineralization in 3-D. It’s not just a small trench with a little surface area. Basically, we exposed a big cliff.

KIRIL MUGERMAN: That’s where we said, “Oh my god.” We thought those zones were sub-vertical, but really they are sub-horizontal. From a tight-folding model, this has understanding has been converted.

ALLAN BARRY: Are you seeing any zonation of the grade?

KIRIL MUGERMAN: Those layers are thrust faults. In terms of tectonics, as the GRENVILLE basin was contracting you had areas that get squished and jump on top of each other. Slide 10 has a map showing the zones of Sherlock where we did the trenching.

KIRIL MUGERMAN: There is one trench which is roughly 150 metres long. It is a skinny one. Then, we have a big trench that is almost 100 metres long by 50 metres wide. That is SHERLOCK 38.

ALLAN BARRY: I’d advise you to go to their website look in the investor section. You can find what KIRIL is talking about here.

KIRIL MUGERMAN: Those black lines with little triangles pointing to the north show the thrust faults. As you can see, we’ve now identified four thrust faults. Even if you had one horizon that was mineralized, by the time you thrust-fold them on top of each other, you make a sequence of four layers or horizons.

ALLAN BARRY: That’s a pretty major discovery for you to go from sub-vertical to sub-horizontal.

KIRIL MUGERMAN: Correct.

KIRIL MUGERMAN: What does it mean for us? First of all, volumes are easier to add up when everything is horizontal than vertical, drilling-wise. Second, our drilling angle was completely wrong. All the drill holes that we drilled in November and December are all vertical.

ALLAN BARRY: And this is why people like ANDRE GAUMOND and others are so thorough about their exploration efforts. It can change things on a dime.

KIRIL MUGERMAN: Yes, and I have school friends working for majors now who swear by trenching. A good trench can answer 50 questions, while a drill hole will answer one question and pose another 50!

KIRIL MUGERMAN: Drilling vertical holes is key. With an angle hole, you can easily drill in underneath the stacks without hitting almost any mineralization. Whereas, if you are drilling vertically then you will always hit your mineralization wherever your horizon is present.

KIRIL MUGERMAN: Think about that. With an angle hole, you can easily go and drill underneath the stacks without hitting almost any mineralization. When you’re drilling vertical, you’re always hit your mineralization wherever your horizon is present.

KIRIL MUGERMAN: On our website, we have a summary of all the drill results from last year. Those are angled holes.

KIRIL MUGERMAN: What is 120 metres of 0.34% Cu? Well, it included horizons of, say, thirty metres of 0.6% Cu. And then deeper another 20 metres of 0.6% Cu. Then sometimes it would be 60 metres-70 metres of 0.5% Cu.

KIRIL MUGERMAN: In the discovery hole, it was 67 metres of 0.46% copper and 3.5 grams silver.

ALLAN BARRY: This, ideally, would be an open-pit type of situation.

KIRIL MUGERMAN: Yes, the mineralization starts, literally, from surface. You walk on it. You can pick up chunks of marble that have some sort of crystals of bornite, chalcocite, or chalcopyrite. Not as much chalcopyrite.

KIRIL MUGERMAN: In some holes, we drilled 50 metres of 0.4% copper. And 30 metres of 0.5%. Now that we are going to be drilling those horizontally, they’re not going to be intermixed with the chunks in between that are less mineralized.

KIRIL MUGERMAN: This is what we are trying to explain to the market. It will be much easier with the grades coming out as of January to understand a geological mining model with those horizontal layers of marble.

KIRIL MUGERMAN: Sometimes in the southern portion of your thrust faults — like where Sherlock is on on that map. You’re literally starting from mineralization.

KIRIL MUGERMAN: When you move to the north, you’re not starting from mineralization. You’re starting from more gneissic units on top. As you drill vertically, then you start hitting those horizons.

KIRIL MUGERMAN: On slide 9, you can see the full extent of Sherlock — the bottom portion of those marbles. At SHERLOCK, we get marbles for a kilometre here from east to west. It’s a kilometre of marble mineralization 400 metres wide.

KIRIL MUGERMAN: In the southern portion, we get mineralization from surface.

KIRIL MUGERMAN: In the north, we drilled vertically last year and got mineralization as deep as 160 metres. We have our internal calculations and you can roughly play with the numbers based on the grades that we are presenting in our tables — the summary table for drilling from 2017-2018.

KIRIL MUGERMAN: You can get horizons throughout this unit of 40-60 metres with grades average 0.5, 0.6, 0.7% copper in those marble horizons.

KIRIL MUGERMAN: As an open pit with this sub-horizontal concept, you will never put into a mill 20 metres of gneiss that is not mineralized. It’s easy — you just go and remove it.

KIRIL MUGERMAN: In our first model with the sub-vertical orientation, it was harder.

ALLAN BARRY: It had more dilution.

KIRIL MUGERMAN: Yes, and that risk is now being eliminated. You can play with your internal estimates of a kilometre by 400 metres with layers of 60 metres. You’ll get a lot of copper in there. That’s what we are trying to delineate right now with this current 5,000 metre drilling program.

KIRIL MUGERMAN: We’ve completed 3,900 metres in this Sherlock area. Sherlock and Irene, which is the northern portion of this area. SHERLOCK 34 is all the way to the west. SHERLOCK 38 is all the way to the east. All those areas have been tested by drilling with vertical holes.

KIRIL MUGERMAN: We slowly started filling-in some areas. We stopped for the holidays, but when the guys come back in January and we’re waiting for results, they are going to go to the ELEMENTARY zone.

KIRIL MUGERMAN: ELEMENTARY is 1.5 kilometres north of SHERLOCK.

ALLAN BARRY: You can see it in the map to the north. And you’ve got the same kind of rocks.

KIRIL MUGERMAN: It’s the same thing. We have the exact same kind of rocks all the way 15 kilometres to the north at Nasigon. That’s where the next big marble sequence comes out. Here, at SHERLOCK-ELEMENTARY, it is only 1.5 kilometres that we have not yet in-filled. We still have to in-fill drill and process more surface trenching next summer.

KIRIL MUGERMAN: In the meantime, we managed to demonstrate mineralization over 1.5 kilometres on surface at ELEMENTARY. The best trench was ELEMENTARY 08, which gave us 14 metres at 0.93% copper on surface. It’s all bornite and chalcocite in there. You won’t find any crystals of chalcopyrite in there and that’s the beauty of it.

KIRIL MUGERMAN: When we did the metallurgy test work, everything flowed beautifully. We ran a few cycles of flotation and got 59% copper concentrate on 79% recovery. By the time we optimized it a little bit, you’ll have a copper concentrate of probably approximately 35% with recoveries that we’ll try to get to 90%.

KIRIL MUGERMAN: And this is without discussing any ore-sorting test work.

KIRIL MUGERMAN: We did our first box sample last summer. We sent it to Germany for test work and, slowly, results are being provided to us. We are still waiting for official reports and results to tell us, but the idea for ore sorting is to take the transition zone.

KIRIL MUGERMAN: There is an inter-bedded zone of marbles and stone. Whenever you are in between your marbles, you want to run this through an ore sorter. You don’t want to sort the units which are already running at 0.5-0.6% copper. They are good. You only want to sort ore to get rid of the bad stuff. Keep the good stuff.

ALLAN BARRY: Correct.

KIRIL MUGERMAN: Last year when we were just starting with the metallurgy, we said we weren’t aware yet of the horizontal model. We said, “Look, here’s 120 metres and we want to sort them.” But now, we see it differently. And we need less sorting than we originally thought because the vertical drilling shows the grades of the actual massive marble unit is really good. Good enough to go straight to the mill without having to be processed.

ALLAN BARRY: Let’s get into a little bit about the access. You’ve got a private road going right through all these places where you’re doing the work.

KIRIL MUGERMAN: It’s a little bit more than just private access.

KIRIL MUGERMAN: We bought the FER A CHEVAL outfitters in August 2019. This came with private roads that they had for hunting on logging roads. They are operational roads for hunting and fishing that people have been using over the years.

KIRIL MUGERMAN: The group that developed this outfitter even brought their own powerline. Look at slide seven — zoom in on the upper picture to see where the cars are parked. If you zoom in, you can actually see their power line.

KIRIL MUGERMAN: This camp can fit almost 150 people.

ALLAN BARRY: That’s really important for anyone looking at this as a potential mining operation. To have road access, power lines, helicopter pads, it even looks like you can do some fishing for your lunch — you’ve got sleeping accommodations. You’re not looking at some remote situation here.

KIRIL MUGERMAN: The fuel stations and everything is permitted. We use that camp right now. Literally, we rent it out to the forestry industry. They lodge their people.

KIRIL MUGERMAN: We lodged some of the Hydro-Québec employees. We’re 15 kilometres away from the major Hydro-Québec substation called Poste La Vérendrye.

KIRIL MUGERMAN: Hydro-Québec has major operations there. They maintain the big, massive hauling road, as well, together with the forestry industry. You can drive, literally, 80 kilometres an hour, non-stop from Montreal to that place and you’ll be there in, say, four and a half hours maximum.

ALLAN BARRY: Exceptional. You’ve got a lot of infrastructure right there.

KIRIL MUGERMAN: We’ve added the little roads to get to the trenches. The main thing for me is to be able to get to that camp. It has easy access and that’s great.

KIRIL MUGERMAN: That’s really what helps thinking of any future development. My operating cost is going to be lower here because you can put electric trucks on it if you want. You’re fully connected to the grid.

KIRIL MUGERMAN: What if you want to have your floatation plant to not run on diesel but run on hydropower instead? Your costs are automatically going lower for any processing.

ALLAN BARRY: For the investors out there, that has a big difference in the grade that you need to find to make money. That’s what the miners are going to be worried about.

ALLAN BARRY: KIRIL, in summary, you’ve got large exploration potential. You’ve done a very thorough exploration job. You’ve got the infrastructure and you’re drilling now to prove-up a new concept of the mineralization! When do you expect some drill results in January? And then more drilling? How do you see things going for the next six months or so?

KIRIL MUGERMAN: Yes, we’ll start getting results as of January. That’s pretty much the first objective as of the second week of January. We’ll start drilling on the ELEMENTARY zone. By the time the ELEMENTARY zone drilling is finishing, we’ll probably start getting some of those first results. Good chance that we’ll send the drill rig back to the SHERLOCK area to start doing some in-filling.

KIRIL MUGERMAN: All that will be finalized already in the new year. Right now our target is to hit that 5,000 metres, but I wouldn’t be surprised if we go for more than 5,000 by adding more drill holes in the SHERLOCK area.

KIRIL MUGERMAN: By the time we finish drilling in January, we will be getting results throughout the entire first quarter — January, February, March. Who knows, maybe even some drill results in April.

ALLAN BARRY: I guess you are able to drill here pretty much year-round?

KIRIL MUGERMAN: Yes.

KIRIL MUGERMAN: This is not in the swampy Abitibi territory where you can drill mostly in the winter. Here, you can drill anytime you want. Obviously, you cannot drill from the lakes in the summer but, ground-wise, it’s very stable and solid ground. You have very little swampy area that cannot be accessed in the summer.

ALLAN BARRY: How’s the financing situation?

KIRIL MUGERMAN: At the moment, we are at over $4 million dollars. We are financed. We don’t have to run to the market. We are drilling and, hopefully, with those drill results, we’ll be able to secure a deal with a partner. We hoped to secure that last year when copper was hot, but copper pricing changed very fast. From well over $3 to around the 260 range. That changed the appetite for the majors to get involved in new projects.

ALLAN BARRY: I think this new understanding could turn everything on a dime for you guys.

ALLAN BARRY: The share structure — how much stock is out and what’s the valuation these days?

KIRIL MUGERMAN: We are trading at approximately 13 cents. We did have a weak year, but consider that we had no drilling for a year.

ALLAN BARRY: Exactly.

KIRIL MUGERMAN: We have now 90 million shares outstanding, pretty much. Most of the warrants at the $0.14 are either exercised or are about to expire. Now they’re out of the money, so there will be no overhang.

KIRIL MUGERMAN: The options are around 8 million outstanding. We’re looking at a little over a $100 million valuation in Canadian dollars these days.

ALLAN BARRY: That’s fully diluted?

KIRIL MUGERMAN: Yes. And we are generating a bit of cash from operating that FER A CHEVAL operation.

ALLAN BARRY: Good. It’s harder these days to find good copper plays. I’m bullish on the price of copper going forward. All over the world, there are issues with copper mining. Potential for strikes, not enough exploration, not enough new mines being developed — I think this is a bullish situation for copper going forward.

ALLAN BARRY: And there hasn’t been a lot of copper-focused explorers in a place like this. But there is infrastructure around, so I like it. I think we’ve done a good job here, KIRIL, to give people an outline of what you guys are doing and what you’re expecting over the next little while.

ALLAN BARRY: I want to thank you for your time. You’ve been very generous with it and I highly recommend KINTAVAR for those who are looking for copper explorations in a wonderful jurisdiction like Quebec with the infrastructure everywhere, the size potential, lots of money for drilling, and a reasonable valuation. KINTAVAR is a good one for you to look at.

KIRIL MUGERMAN: If ever you come to Quebec during the summer, just let us know and you or any of your listeners that are around Quebec, Ontario, or even the USA — it’s easy for us to accommodate people to come and visit the site. You don’t have to fly all the way up north to see it, you just have to come to our little FER A CHEVAL. The Geo team will be more than happy to show you all the trenches and why we are doing it all. Anybody is more than welcome to contact me directly, I’m very open to that as well. We’d like to see you there next summer.

ALLAN BARRY: You might just find me up there! It looks like a wonderful place. I love Quebec and the people of Quebec. One day — KIRIL, excellent. Thank you. Thanks, folks. As always, the show is for information purposes only. It’s important for you to speak with your financial advisors and do your homework.

ALLAN BARRY: I’ll close on on this is a good one for you to check out go to their website at KINTAVAR dot com. They provide a lot of thorough information. They do thorough exploration! They explain their story well and I invite you to check them out.

KIRIL MUGERMAN: Have a great day and we’ll talk to you soon

—

Study along with our December 2019 pitch deck for more information,

Corporate Presentations

Find more in an interview with Small Cap Power at VRIC 2020 here. Thanks very much to Small Cap Power and StockPulse for your quality interviews about our copper discovery in Quebec.