Kiril Mugerman, StockPulse Transcript c. 5,000 Words

Thanks to StockPulse for this new interview. Read the transcript of our +40 minute conversation with Mr. Allan Barry Laboucan at this link,

Kiril Mugerman, StockPulse Transcript c. 5,000 Words – Kintavar

Kiril Mugerman, StockPulse Transcript c. 5,000 Words HiddenTreasures: Kintavar ExplorationStockPulse, December 20th 2019.TRANSCRIPT -Text quotes KIRIL MUGERMAN, CEO of KINTAVAR unless otherwise noted. This episode features KINTAVAR EXPLORATION. Ticker KTR on the Venture Exchange. CEO KIRIL MUGERMAN now ALLAN BARRY, hello. ALLAN BARRY: Thank you for joining me, it’s Allan Barry Laboucan from the Allan …

—

Read an excerpt from the conversation with our CEO Mr. Kiril Mugerman and Allan Barry Laboucan,

KIRIL MUGERMAN: That’s how it all started, then we raised $10 million dollars in 2018 on the success of those results. It was the first time we had primary copper mineralization in Quebec in — what? I believe it was over 20 years? We got the Quebec pension fund involved. They hold, today, I believe 14% of the company.

ALLAN BARRY: Not everybody that’s listening to the show is aware of what kind of investors those funds are, but they’re often just like an insider. They’re not buying it really for investment purposes, so much as giving you funding to go ahead and do exploration. That’s what they’re promoting.

Quebec has a lot of interest in investing in local projects of merit. They say, “We are going to take a position. We want to make sure you have the money, we want to see it progress. If it’s a good project we’ll reinvest again. We’ll reinvest again.” And they basically never sell until they say “OK. We think that project is no good anymore.” Or if they have to get below 10% ownership.

They try to stay below 10%, as with most of the Quebec institutions. In our case, we were the first company “pre- Resource Estimate” where they took a position more than 10%.

ALLAN BARRY: And this was SOQUEM?

No, this is the Quebec pension fund, the CDP. They invested. The Labour Fund invested. The People’s Bank invested. Those funds took a very large stake in the company.

I believe today by the time you look at all the private equity groups that hold the positions here with us plus a lot of the people from the region where we are — we haven’t really discussed it yet, but the local people in the region of MONT-LAURIER where we found this property are invested.

As I said, we are outside the traditional “northern Quebec gold zones”. We are really in the forestry region.

The people of MONT-LAURIER hold together 25-30% of the company. They are all private investors. They are all below 10%. Some of them hold 3, 4, 5% each and they’re big believers in developing their region.

Their region does not have mining.

There is a graphite mine back from the 60-70’s that’s still operational and that’s the only mine in the region. All the GRENVILLE mines for iron ore are further north.

ALLAN BARRY: Yes.

We raised ten million dollars and we started bringing many majors to site. Showing them what it is. Everybody was very curious and from then until now, it’s continuing. It’s an educational process to the investor because when people see a hundred twenty metres of mineralization of 0.34% copper, they automatically think okay it must be a porphyry deposit. It is not.

It is a stratiform copper.

They got squished so badly that everything is basically folded.

Now, this was the interpretation of 2017-2018. In 2019, you refer to the trenching. We did a lot.

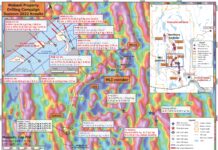

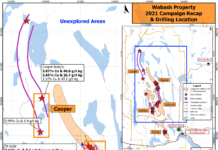

Why did we do so much trenching after already completing ten thousand metres of drilling over the entire property.

ALLAN BARRY: Because you could strip-back the dirt to bedrock and take samples!

Correct. We can get much more information from surface.

See pictures from the MITCHI here,

Pictures