Kintavar Intersects 0.63% Cu, 7 g/t Ag over 20.15m in Sherlock...

See PDF here

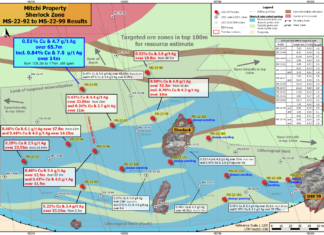

Montreal, Quebec, March 03, 2023 – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce the remaining results...

Kintavar Obtains 0.51% Cu over 65.7m including 0.84% Cu and 7.8...

View PDF here

Montreal, Quebec, February 16, 2023 – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce the initial results...

Kintavar Closes $411,900 Flow Through Private Placement for Next Phase of...

View PDF here

Montreal, Quebec, December 08, 2022 – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce that it has...

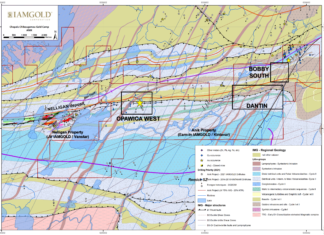

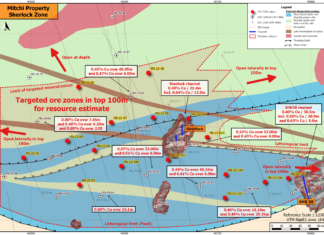

Kintavar Completes 1,780m Infill Drilling at Sherlock Zone, Mitchi Project; Extends...

View PDF here

Montreal, Quebec, December 08, 2022 – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce that the infill...