Kintavar Intercepts 5.35m @ 1.19% Cu and 28.4 g/t Ag at...

View pdf here

Montreal, Quebec, March 24, 2022 – – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce the results...

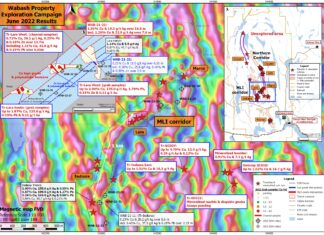

Surface Channel Returns 0.71% Cu, 30.1 g/t Ag, 0.23% Pb &...

View pdf here

Montreal, Quebec, March 24, 2022 – – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce the recent...

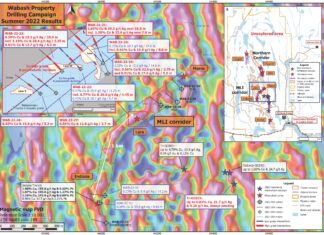

Wabash Copper Project Exploration Update – Start of Summer Drilling Program...

View pdf here

Montreal, Quebec, July 28, 2022 – – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is pleased to announce the start...

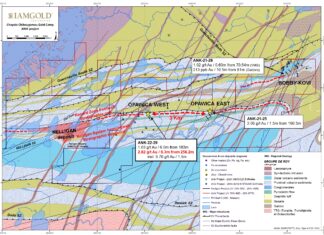

Anik project: IAMGOLD intersects 2.82 g/t Au over 6.3 m, extension...

View pdf here

Montreal, Quebec, March 24, 2022 – – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is very pleased to announce the...

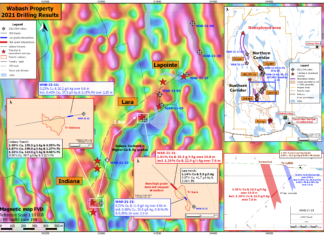

Kintavar intersects 1.01% Cu, 19.3 g/t Ag near surface over 16.8m...

View pdf here

Montreal, Quebec, March 24, 2022 – – Kintavar Exploration Inc. (the “Corporation” or “Kintavar”) (TSX-V: KTR), is very pleased to announce the...

Kintavar Assays 0.73% Cu, 20.5 g/t Ag & 1.11% Mn over...

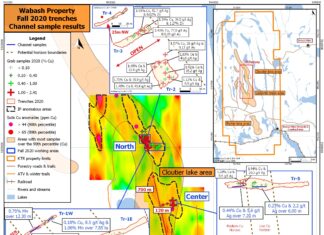

“The Wabash copper-silver property is demonstrating excellent potential. We are seeing the first confirmation of higher-grade horizons with 0.73% Cu and 20.5 g/t Ag over 7m that remain open to the West. The strongest and the biggest IP anomaly that measures over 1km long by 250m wide and several other significant anomalies have not yet been tested and will be priority targets for the upcoming exploration program. We wanted to get as much data as possible from Wabash before winter started. We followed what we had at the time and had made excellent progress. Now, from combining the channel results and the geophysical data, we can see that mineralization has good correlation with the IP anomalies and that we are working with various horizons. The right conditions appear to be there to identify a significant width copper zone at surface over several kilometers. The objective for Wabash is clear now: identify the best copper and silver horizons, follow them and build up volume.” commented Kiril Mugerman, President & CEO of Kintavar Exploration.

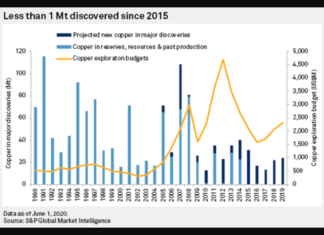

Major Copper Deposit Dismal Discovery Rate Continues

"This year’s analysis of major copper discoveries has identified 224 copper deposits discovered over the 1990-2019 period, containing 1.08 billion tonnes of copper in reserves, resources and past production. Of the 224 copper deposits discovered, only 16 have been found in the past 10 years and only one since 2015. While there is still an abundance of undeveloped discoveries, most are smaller or low grade, with relatively few high-quality assets available for development."

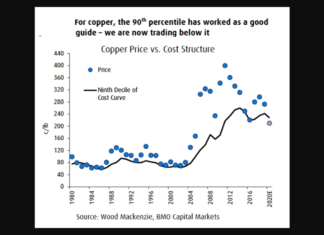

Copper Research by Colin Hamilton, BMO

"As the graph shows, copper is trading below its long term price floor based on the global production cost curve with 14% of copper operations around the world losing money at today’s price. Of all commodities, the 90th percentile of the cost curve – some $5,200 a tonne at the moment – has worked as a support level best in copper..."

Andy Home @AndyHomeMetals “… yet”

"That’s not to say copper and the other base metals couldn’t tumble further in price. China’s full economic recovery is going to take time. Citi, for example, expects “economic stagnation” in the first quarter, “some improvement” in the second and a “much stronger” second half prompted by stimulus. The country’s internal metal dynamics have been massively disrupted and short-term stresses are clear. Producers have largely managed to keep operating over the last month even while many downstream manufacturers have remained closed. This has led to ballooning inventories of metal and calls for government help. Physical supply-chain dislocation could yet bite copper if China’s import flows are redirected towards LME warehouses, even if briefly. Citi analysts think copper could lurch lower to $5,200 over the next couple of months before a China-led recovery picks up steam in the second half of the year. That’s a relatively benign bear forecast relative to what’s just happened to the oil price and stock markets. Each of those had its own specific drivers. China is copper’s driver right now, and the good “Doctor” seems to be hopeful about the country’s recovery prospects."

Copper market is a coiled spring Richard Mills – Ahead of...

"Right now the copper market is suffering a little due to the coronavirus and trade wars but we expect these to be temporary phenomena. All it means is a delay on the inevitable copper surge that is coming – when trade impediments are solved and the coronavirus is contained, hopefully eradicated, expect copper prices to burst higher like releasing a coiled spring."

Copper M&A Update Report — Copper Projects Review 2020

M&A opportunities limited: However, we also showed that the opportunities for M&A were limited because: many copper companies that are potential takeover targets have difficult shareholding structures; the number of quality asset disposals from existing copper producers is likely to be a lot lower than in the past; and there are a limited number of late-stage development copper projects with resources of greater than 3.0Mt contained copper that are likely candidates to be acquired.

With Copper Stocks Tapped Out, Banks See a 2020 Price Spike,...

Copper’s tight supply situation was masked by the trade tensions, according to Darwei Kung, head of commodities at DWS Investment Management Americas Inc., who is bullish on the metal. Now with a preliminary truce between the countries, copper is looking “positive” this year, he said.