Kintavar Exploration at VRIC 2020

Learn more about our copper discovery at the Mitchi with our CEO Kiril Mugerman and Small Cap Power. Thanks Mark Bunting and Small Cap Power!

Mark Bunting: Joining us now is Kiril Mugerman, he’s the CEO of Kintavar Exploration. Good to see you again.

Kiril Mugerman: Hi Mark, thank you very much.

Mark Bunting: We talked in December of 2018 on Capital Ideas and I’m sure you’ve done some interviews with Small Cap Power as well. Update us on the story and remind everybody about what you’re doing with Kintavar.

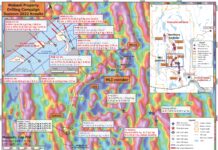

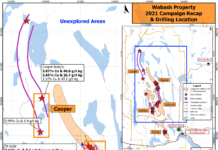

Kiril Mugerman: Kintavar is a copper exploration company in Quebec. We got well-financed in 2018. We drilled through the end of 2018 into 2019. In the summer of 2019, we did a lot of re-interpretation of the geology. Now, for the first time in 12 months, we started drilling in November of last year. Today, we released the first results from this new exploration model that we are putting together. Basically, we changed the orientation of the stratigraphy from being folded — tight-folded and sub-vertical — to sub-horizontal units. We changed the drilling orientation, as well. Now we are going vertical. That gave us a different perspective. As well, the grades are changing from what we’ve seen before.

Mark Bunting: Please give us an overview of the news release that you came out with today.

Kiril Mugerman: Basically, we have a unit of rock that is a kilometer by 400 meters. With the new model, we had to start plugging in holes to test this theory and this press release gives the first six holes from this model. They all hit several of those layers being mineralized with a gap of non-mineralized material in between them, which is perfect because you don’t want to mine the whole thing. You don’t want a huge mill — you want a smaller mill, smaller capex. That’s what everybody is looking for right now — smaller projects, smaller capital cost, less capital intensive projects. The main hole from this press release is 53 meters of 0.53% copper. That is basically half a percent copper from surface, which is great. It gives you an opportunity to start seeing how a starter pit in this area can form.

Mark Bunting: Explain to investors Kiril, why they should look at Kintavar Exploration differently and be excited about it compared to all the other companies at this event, for example?

Kiril Mugerman: Copper is unique. There isn’t that much of it — the majors are limited to looking at huge projects that are typically porphyries in Chile. In terms of global opportunities to invest in copper projects, we are in a very stable jurisdiction in Quebec. Last year, we acquired all the infrastructure in the area from a large operation for fishing, hunting, and lodging. We bought that out and we now own the camp for 150 people. We own the powerline. My project is now connected to the grid. We own the fuel station. If somebody wants to start developing it, everything is there. That’s the advantage. I’m in early-stage exploration, but there is this clear path to the development stage. We are drilling and we are well funded. Copper is still below $3, so it’s not really in the bull territory, but that’s where people should be looking for opportunity — who is well funded in the copper space and not just another copper porphyry, which will several billion dollars in capex? Our project will be significantly less.

Mark Bunting: And what’s the timeline to production?

Kiril Mugerman: Too early to say. We still need to get to the first resource estimate, which is why we are drilling and expanding our zones. Once we get the first resource estimate, you will have to go to a preliminary economic assessment. The objective is to bring in a major partner as soon as possible.

Mark Bunting: We’ll be watching!

Kiril Mugerman: Thank you very much, Mark.

Mark Bunting: Kiril Mugerman, CEO of Kintavar Exploration.

Learn more about our copper discovery in our presentations here.